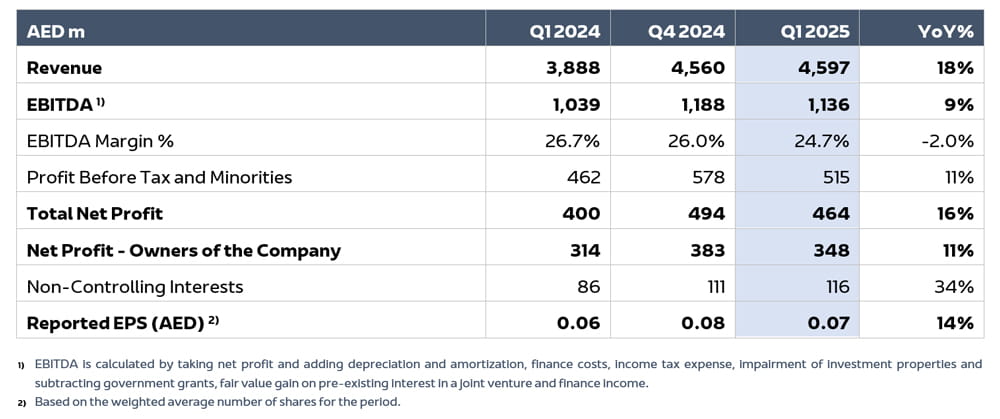

AD Ports Group Begins 2025 on a Strong Note with Q1 Revenue Increasing 18% and Total Net Profit 16%

May 09, 2025

Abu Dhabi, UAE – 9th May 2025: AD Ports Group (ADX: ADPORTS), an enabler of integrated trade, transport, industry, and logistics solutions, today announced its financial results for the first quarter ending 31st March 2025.

Building on the momentum of 2024’s record financial performance, AD Ports Group started 2025 with impressive double-digit growth from top-line to bottom-line, driven by the Ports, Economic Cities & Free Zones (EC&FZ), and Maritime & Shipping clusters.

Key Financial Results in Q1 2025

- AD Ports Group revenue reached AED 4.60 billion in Q1 2025, growing by an impressive 18% YoY (Year-on-Year), with the Ports, Economic Cities & Free Zones, and Maritime & Shipping clusters being key drivers behind the strong performance.

- Group EBITDA amounted to AED 1.14 billion in Q1 2025, translating into a 9% YoY growth, driven by a 17% YoY increase in Ports, 10% YoY in Maritime & Shipping, and 7% YoY in Economic Cities & Free Zones (Group EBITDA Margin stood at 24.7% in Q1 2025).

- Total Net Profit soared 16% YoY to AED 464 million, mainly driven by the operating performance.

- EPS for the quarter stood at AED 0.07, implying a 14% YoY increase.

- With marginal increase in Total Debt and continued strong liquidity position, Net Debt/EBITDA was relatively stable at 3.4x as of Q1 2025, vs. 3.3x at end of 2024.

- CapEx for the first quarter of the year reached AED 954 million, with majority of cash outlays going into Economic Cities & Free Zones, Ports (including AED 182 million going into new and renewal of ports concessions), and Maritime & Shipping assets. Capex intensity continued to decline, reaching 21% of Group revenue in Q1 2025, vs. 33% in Q1 2024.

- Operating Cash Flow, which amounted to AED 725 million in Q1 2025 compared with AED 781 million in the same period in 2024, was primarily impacted by the timing of collections, and thus unfavourable working capital changes. As a result, Free Cash Flow to the Firm (FCFF) was slightly negative for the quarter at AED -173 million.

Visibility on the global macroeconomic front continues to be challenging given current geopolitical volatility in regions such as the Red Sea, and the disruptive effects of US tariff policies. However, AD Ports Group is well positioned geographically and through its holistic five-cluster integrated business ecosystem, and its asset base and service offering, to deal with the ongoing uncertain and unpredictable environment. The Group’s resilient business model and agility enables it to adapt to shifting cargo flows and to seize arising opportunities in regions of focus: Middle East, Red Sea, Europe, Africa, Indian Subcontinent, Central Asia, Southeast Asia, and Latin America.

The Group continues to focus on long-term, resilient infrastructure assets (Ports and EC&FZ clusters) in terms of capital allocation and profits contribution, with the support of strong Maritime & Shipping, Logistics, and Digital capabilities and operations.

The Red Sea disruptions continue to impact positively the Group’s container shipping business while the evolving US tariff policies have had (and are expected to have) an immaterial effect based on the announcements that have been made so far.

Captain Mohamed Juma Al Shamisi, Managing Director and Group CEO, said:

“The positive momentum from our record 2024 financial results continued into the first quarter of 2025, as our resilient and value-adding business ecosystem of interrelated trade, transport, and logistics businesses weathered prevailing macroeconomic and geopolitical uncertainties to drive strong, double-digit growth in revenue and net profit. The Q1 solid growth was driven by our Ports, Economic Cities & Free Zones, and Maritime & Shipping clusters, which continue to benefit from our agile response to ongoing geopolitical crises and our ongoing investments in core infrastructure amidst our international expansion. In line with the vision of our wise leadership in the UAE, we will continue to follow this prudent, profit-enhancing ‘intelligent internationalisation’ strategy this year as we carefully navigate the turbulence around us to maintain course and position of AD Ports Group, and Abu Dhabi, as world leaders in sustainable trade, transport, logistics, and economic development, drawing on the latest AI and technology innovations.”

Key Business Developments in Q1 2025

- Entered a 51%-owned JV to develop a greenfield grain terminal at Kuryk Port in Kazakhstan.

- Started port and logistics operations at Luanda Port in Angola.

- Signed a 50-year land lease agreement with Al Ain Mills for a 50,000 sqm grain storage and processing facility at Khalifa Port South Quay, which will boast a storage capacity of approximately 300,000 metric tonnes.

- Brought in CMA CGM Group with 49% ownership in the JV that will develop and operate New East Mole Multipurpose Terminal at the Port of Pointe Noire in the Republic of Congo-Brazzaville, the 30-year extendable concession that AD Ports Group secured in June 2023.

- Secured a contract to manage and operate the 1.3 million sqm Al Madouneh Customs Centre in Amman, Jordan. The cutting-edge facility was recently launched to support the country’s trade competitiveness through AI-driven customs solutions, blockchain-enabled transparency, and Internet of Things (IoT)-powered logistics optimisation.

- Formed a 70%-owned JV with Arab Shipbuilding & Repair Yard Company (ASRY) for the provision of marine services in Bahrain.

- Signed a 50-year land lease agreement with ETG Bio Green Polymer for a 22,000 sqm compostable polymer resin factory in KEZAD. The 100% sustainable polymers will help businesses transition to plastic-free packaging solutions.

- Launched a JV, “United Global Ro-Ro” – Noatum Maritime (60%) and Erkport (40%), to facilitate global Ro-Ro and vehicle transport. Noatum Maritime and Erkport will jointly deploy Container Ro-Ro (ConRo), Pure Car and Truck Carrier (PCTC), and Ro-Ro vessels. The JV will start with 11 vessels on five services.

- Started operations of Al Faya Dry Port facility, a custom-bound inland container depot strategically located between Abu Dhabi and Dubai to serve all Northern emirates, which aims to drive Khalifa Port’s O&D container volumes. Al Faya Dry Port will serve CMA CGM as its first key client but will be scaled up to also serve AD Ports Group’s other strategic shipping partners at Khalifa Port, such as COSCO and MSC.

- Signed a 50-year land lease agreement with Bisconni Middle East, part of Ismail Industries – Pakistan’s largest confectionery, biscuits, and snack food manufacturer, for a 37,000 sqm facility in KEZAD.

- Launched the first phase of Metal Park Storage Hub in KEZAD, which offers storage solutions and support services for the metal industry.

- Formed a 50%-owned JV with Columbia Group, which boasts an integrated maritime, logistics, leisure, energy and offshore services platform, to optimise third party vessel operations through advanced fleet management systems and AI-driven performance analytics. The digital platform will provide fleet performance enhancement, predictive maintenance, and regulatory compliance to optimise voyages, speed, bunker usage, emissions, etc.

- Signed two long-term lease agreements at Khalifa Port: 1) 50-year lease with Olyz Terminals for developing a petroleum storage terminal; and 2) 10-year lease agreement with TW Steel for container fabrication and maintenance services.

AD Ports Group has been stepping-up its value-accretive ESG and decarbonisation efforts since the beginning of the year, including the above-mentioned land lease with ETG Bio Green Polymer, but also with investments in two all-electric pilot and a tug boat, and two LNG-powered Pure Car and Truck Carrier (PCTC) vessels under UGR, the Ro-Ro shipping JV with Erkport. Additionally, AD Ports Group has started extending LNG bunkering services at Khalifa Port, with the first ship-to-ship service completed in April.

Key Financial KPIs Q1 2025