AD Ports Group Delivers Strong Q2 2025 Results

August 13, 2025

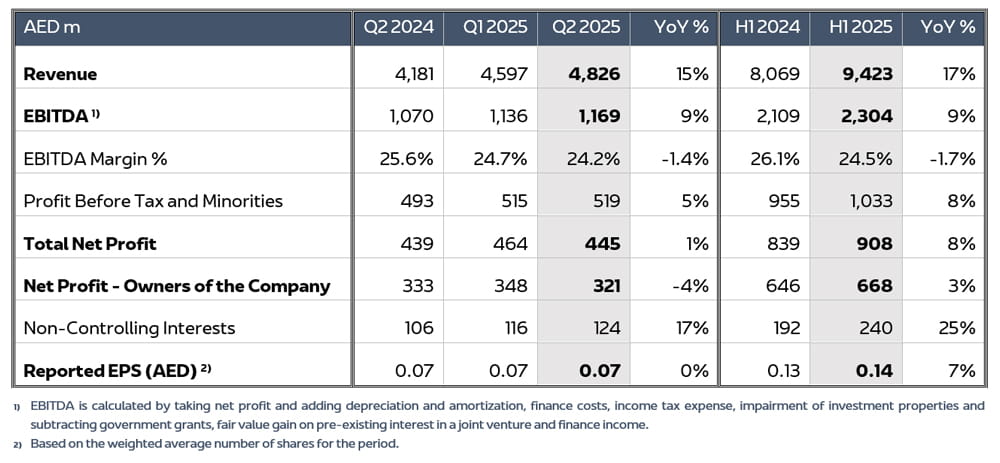

+15% Revenue Growth to AED 4.83 Billion and +9% EBITDA Growth to AED 1.17 Billion; Free Cash Flow Positive for the Quarter and Year-To-Date

- Q2 2025 Profit Before Tax (PBT) growth of 5% YoY to AED 519 million

- Profit performance is expected to improve in the second half of the year

- Free Cash Flow to the Firm (FCFF) positive for both the quarter and year-to-date on soaring Operating Cash Flow (OCF) and continued decline in CapEx intensity

Abu Dhabi, UAE – 13th August 2025: AD Ports Group (ADX: ADPORTS), a global enabler of integrated trade, transport, industry, and logistics solutions, today announced its financial results for the second quarter and first half of the year ending 30th June 2025. AD Ports Group’s growth story continued in the first half of 2025 with double-digit top-line growth recorded in both Q2 and H1 2025, driven by the Ports, Economic Cities & Free Zones (EC&FZ), and Maritime & Shipping clusters.

As supply chains continue to recalibrate, the Group’s integrated five-cluster ecosystem, anchored by a robust asset base and end-to-end service capabilities, continues to demonstrate both resilience and adaptability in volatile and disruptive times. This has enabled the Group to respond swiftly to shifting cargo flows and to capitalise on new trade opportunities across our strategic focus regions: the Middle East, Red Sea, Europe, Africa, Indian Subcontinent, Central Asia, and Southeast Asia.

The Group continues to focus on long-term investments in infrastructure assets through the Ports and Economic Cities & Free Zones clusters, while the Maritime & Shipping, Logistics, and Digital clusters provide critical support in creating a network effect, improving connectivity to the Group’s key markets, and adapting to evolving market dynamics.

While the Red Sea situation continues to pose a risk to global trade, the Group has been able to mitigate adverse impacts and, in fact, has capitalised on increased demand for both reliable passage through the Red Sea and alternative trade routes. Recent commercial progress in markets like Egypt and Central Asia shows the Group’s commitment to investing along existing and emerging trade routes. In parallel, ongoing policy shifts such as new US tariffs have added further complexity to global trade flows. The potential impact of US tariffs remains under close watch, though current announcements have not resulted in material effects as disclosed in the strong set of operational performance delivered year-to-date.

The Group’s underlying operational performance was strong across the Ports, Economic Cities & Free Zones (EC&FZ), and Maritime & Shipping clusters, which all together constituted over 90% of total Q2 2025 EBITDA. In Ports, quarterly container throughput soared 17% YoY while general cargo volumes increased 13% YoY. It is worth mentioning the impressive container throughput performance of the CMA Terminal in Khalifa Port, which started commercial operations just at the beginning of 2025, with a quarterly utilisation of 80% (62% year-to-date). In EC&FZ, another 600,000 m2 of land were leased in Q2 2025, bringing the total land leases year-to-date to 1.6 km2, while utilisation in the staff accommodation business, Sdeira Group, made another leap to 80% vs. 63% in Q2 2024, and 75% in Q1 2025. In the Maritime & Shipping cluster, container feeder shipping volumes rose 34% YoY, while the bulk, multipurpose, and Ro-Ro shipping vessel fleet reached 34 as of Q2 2025, up from 28 at the same period a year earlier. Marine services fleet also expanded meaningfully, with 74 vessels as of Q2 2025, up from 65 in Q2 2024.

In Q2 2025, AD Ports Group further reinforced its ESG leadership through ongoing sustainability efforts. The Group signed a milestone collaboration agreement with Masdar, Advario, and CMA CGM Group to explore building an e‑methanol bunkering and export facility at Khalifa Port and KEZAD - an initiative key to accelerating the decarbonisation of global maritime transport through sustainable fuel infrastructure. The Group’s commitment to sustainable maritime operations was also reinforced with Noatum Maritime’s acquisition of the GCC’s first all-electric hydrofoil pilot boat, and the purchase of two fully electric tugboats. Additionally, the Group, together with New York University Abu Dhabi (NYUAD), completed a three-year coral conservation and research project, which explored global coral relocation case studies to develop best practices tailored to the Arabian Gulf's unique environment.

Steady operating profit growth, stable balance sheet, declining capex intensity, and strong generation of cash flow from operations resulted in positive free cash flow to the firm for the quarter and year-to-date

- AD Ports Group’s Revenue surged 15% YoY (Year-on-Year) to AED 4.83 billion in Q2 2025, driven by the Ports, Economic Cities & Free Zones, and Maritime & Shipping clusters.

- Quarterly Group EBITDA increased 9% YoY to AED 1.17 billion, with Group EBITDA Margin standing at 24.2% in Q2 2025.

- Profit Before Tax reached AED 519 million, up 5% YoY, primarily due to the effect of higher depreciation and amortisation charges and finance costs while Total Net Profit was relatively flat at AED 445 million because of higher Income tax.

- EPS for the quarter stood at AED 0.07, flat YoY.

- With marginal increase in Net Debt and continued strong liquidity position, Net Debt/EBITDA has been relatively stable for the past three quarters at 4.1x, but improved significantly YoY from 4.9x in Q2 2024.

- CapEx in Q2 2025 reached AED 928 million, with majority of cash outlays going into Maritime & Shipping, Economic Cities & Free Zones, and Ports assets. Capex intensity continued to decline, reaching 19% of Group revenue in Q2 2025, vs. 28% in Q2 2024.

- Given the strong operating profit performance and with a cash conversion of 97% for the quarter, Operating Cash Flow reached AED 1.14 billion in Q2 2025, almost doubling from the same period a year earlier. As a result, Free Cash Flow to the Firm (FCFF) was positive for the quarter and year-to-date.

Q2 & H1 2025 Financial KPIs

Captain Mohamed Juma Al Shamisi, Managing Director and Group CEO, said:

“The holistic core of AD Ports Group’s five-cluster business model delivered sustainable growth for its shareholders once again in a challenging macroeconomic and geopolitical environment, as strong results from our Ports, Economic Cities & Free Zones, and Maritime & Shipping clusters drove Q2 gains in overall Group revenue and operating profit. As global cargo flows continued to shift against a backdrop of regional conflicts and tariff volatility, the strategic flexibility of AD Ports Group’s synergistic business structure kept our value-enhancing international expansion on course, allowing us to mitigate adverse external factors, while capitalising on opportunities in dynamic regions such as the Red Sea, and along emerging alternative trade corridors we are developing such as in Central Asia. While reduced geopolitical and macroeconomic visibility is expected to continue in the second half of the year, so too is the long-term profitable nature of our value-enhancing internationalisation, which, in line with the vision of our wise leadership in the UAE, and despite all temporary obstacles, is positioning AD Ports Group as a leader in sustainable trade, transport, logistics, and economic development”.

Key Business Developments in Q2 2025

EC&FZ Developments:

- Signed a 50-year renewable usufruct agreement with Suez Canal Economic Zone (SCZONE) to develop and operate a 20 km2 industrial and logistics park near the Egyptian coastal city of East Port Said on the Mediterranean Sea.

- Signed a 50-year land lease with Broaden Energy for a 80K sqm facility to be used for designing and manufacturing Engineering, Procurement, and Construction (EPC) projects and turnkey solutions for hydrogen, solar and wind power projects with a customer investment of AED 455m.

- Signed a 50-year land lease with Witthal Gulf Industries for a 15K m2 facility that will recycle end-of-phase batteries used in electric vehicles, solar farms, and other renewable energy systems, to recover valuable materials such as black mass, copper and aluminium, and produce sustainable alternatives, with a customer investment of AED 40m.

- Signed a 50-year land lease with Axione Development and Stock Space for a 14K m2 facility that will provide prime quality warehousing space and operations catering to the F&B and FMCG industries, with a customer investment of AED 50m.

- Signed a 50-year land lease with Sing Auto for a 100K m2 facility that will focus on green logistics solutions such as intelligent refrigerated vehicles designed to enhance the efficiency of cold chain logistics in the region, with a customer investment of AED 100m.

- Announced the development of KEZAD Business District, a mixed-use commercial hub spanning over 3 km2 that will include office space, sport facilities and F&B retail outlets.

Central Asia Developments:

- Started operations at Tbilisi Intermodal Hub in Georgia, which serves as a key multimodal logistics hub for the Group in Central Asia.

- Announced the commencement of the Central Asian logistics JV Gulf Link, 51% percent owned by AD Ports Group, and 49% by KTZ Express JSC, a multimodal transport and logistics subsidiary of Kazakhstan Railways. Through Gulf Link, AD Ports Group and KTZ Express are offering connectivity through Central Asia, and globally, through Pakistan, Türkiye, the Arabian Gulf, and the Indian subcontinent.

- Expanded the Group’s presence in Kazakhstan, by signing preliminary agreements to develop a Multipurpose Terminal at Kuryk Seaport on the Caspian Sea and to expand the current oil tanker fleet as well as commission up to four new shallow-draft container ships designed for use in the Caspian Sea.

Maritime & Shipping Developments:

- Noatum Maritime and The Arab Shipbuilding and Repair Yard Company (ASRY) marked the operational commencement of their JV to provide integrated marine services in Bahrain. AD Ports Group and ASRY also signed preliminary agreements to enhance dry-docking and ship building capabilities within the GCC and explore opportunities in the broader region, and to create a green ship recycling facility with JM Baxi in their effort to reduce carbon emissions.

Post-Quarter Events:

- AD Ports Group signed an agreement with China’s Ningbo Zhoushan Port Group to establish an auto logistics ecosystem by connecting Chinese OEMs with Middle East, Central Asian, and African markets through terminal operations, dedicated fleet services, and multimodal transport solutions. Plans include to use United Global Ro-Ro, Noatum Maritime’s JV with Türkiye’s Erkport, as the designated Ro-Ro carrier.

- Noatum Maritime opened its first office in China - Shanghai, dedicated to its agency and marine services business.

- Noatum Logistics officially launched its first international office in China - Beijing, allowing the cluster to swiftly respond to emerging trade and logistics opportunities.

- AD Ports Group signed a 50-year land lease agreement at Khalifa Port’s South Quay for a 100K m2 storage facility, including silos, with Emirates Food Industries.