AD Ports Group Reports Record Net Profit of AED 596 Million in Q3 2025, +34% YoY Growth

November 14, 2025

- Strongest quarterly net profit since February 2022 public listing on the back of steady operating profits, lower finance costs, and positive impact from income tax reversal

- Continued double-digit revenue growth driven by the Ports, Economic Cities & Free Zones and Maritime & Shipping clusters

- The infrastructure businesses of Ports and Economic Cities & Free Zones, recorded double-digit top-line and EBITDA growth

Abu Dhabi, UAE – 14th November 2025: AD Ports Group (ADX: ADPORTS), a global enabler of integrated trade, transport, industry, and logistics solutions, today reported record net profit in Q3 2025 - the highest since its 2022 public listing, on the back of double-digit growth in quarterly general cargo volumes and container throughput, a surge in new industrial land leases, higher utilisation rates of its warehouses and staff accommodation facilities, a 31% increase in container feeder shipping volumes, and continued strong Ro-Ro shipping volumes following the launch of its Ro-Ro shipping JV with Türkiye's Erkport, UGR, earlier in the year.

AD Ports Group continued to build on its strong performance momentum in 2025, reinforcing its industry leading position. The Group’s performance reflects its focus on long-term value creation, operational resilience, and strategic market and service offering expansion.

In terms of financial reporting, the Group has simplified and streamlined its corporate structure by transforming its Digital cluster to a federated model in order to better support its growth strategy, efficiency and performance, particularly accelerating AI initiatives and deployment of Agentic AI across its core operations. The vertically integrated and synergistic model is now structured around four clusters - Ports, Economic Cities & Free Zones (EC&FZ), Maritime & Shipping, and Logistics - with digital services better aligned with business requirements, strengthening the Group’s ability to serve external customers and swiftly adapt to fast-changing market conditions.

This integrated approach has enabled AD Ports Group to successfully navigate ongoing supply chain disruptions in global trade and emerging tariff regimes whilst maintaining service reliability and capturing new cargo flows.

Ports and Economic Cities & Free Zones remain the backbone of the Group’s infrastructure-led growth strategy, whilst Maritime & Shipping and Logistics complement and support the infrastructure assets to offer customers a one-stop shop and end-to-end solutions.

Captain Mohamed Juma Al Shamisi, Managing Director and Group CEO - AD Ports Group, said:

“Our record Q3 net profit, the highest since our public listing in February 2022 underscores the ongoing success of our profitable, but prudent ‘intelligent internationalisation’ strategy of positioning AD Ports Group for leadership in some of the world’s fastest-growing trade corridors, in addition to our steadfast commitment to delivering exceptional value to our customers. In Q3 2025, our Group once again grew stronger, and more profitable, as we recorded robust increases in ports container throughput and general cargo volumes, industrial land leases, and container feeder shipping volumes. Whilst the backdrop of regional conflicts and tariff volatility remains a reality of the current global operating environment, AD Ports Group aims to stay one step ahead of the turbulence, driving forward its profitable expansion, and the sustainable transition of our industry, to fulfil our prime mission, which is to enable sustainable trade, transport, logistics, and economic development for the Emirate of Abu Dhabi and the world, in line with the vision of our wise leadership in the UAE.”

Strategic wins in Q3 2025, sustained strong volumes growth, and further improvement in utilisation levels continue to validate the Group’s expansion strategy revolving around investing along key trade routes and turning Abu Dhabi into a global trade and logistics hub with strong connectivity to key regions and the UAE’s major trading partners.

The Group’s underlying operational performance was strong across the Ports, Economic Cities & Free Zones, and Maritime & Shipping clusters.

In Ports, quarterly container throughput soared 20% YoY, whilst general cargo volumes increased 12% YoY. CMA Terminals Khalifa Port, which started commercial operations at the beginning of 2025, was close to reaching 1 million TEUs year-to-date, with a quarterly utilisation of 87% (70% in 9M 2025).

In EC&FZ, another 800,000 m2 of new land leases (net) were signed in Q3 2025, bringing the total new land leases year-to-date to 2.4 km2, whilst utilisation in the staff accommodation business, Sdeira Group, made another leap to 85% vs. 64% in Q3 2024, and 80% in Q2 2025.

In the Maritime & Shipping cluster, container feeder shipping volumes rose 31% YoY to 900K TEUs, driven by increased services and capacity, whilst the bulk, multipurpose, and Ro-Ro shipping vessel fleet reached 43 as of Q3 2025, up from 29 at the same period a year earlier, mainly on capacity expansion for UGR. The marine services vessel fleet expanded as well, with 76 vessels as of Q3 2025, up from 66 in Q3 2024.

On the Balance Sheet front, AD Ports Group continues to actively and prudently manage its financial position, with net debt and leverage levels well under control.

In Q3 2025, AD Ports Group continued to advance its sustainability agenda, reinforcing its Net Zero 2050 pathway, and building on the strong foundation laid in 2024.

The Group continued efforts to expand the integration of sustainable energy and electrification across Ports and Maritime & Shipping operations, through solar PV installation, electric tugs, LNG-powered vessels, and by leveraging enabling technologies such as AI-driven route optimisation and fuel IoT systems.

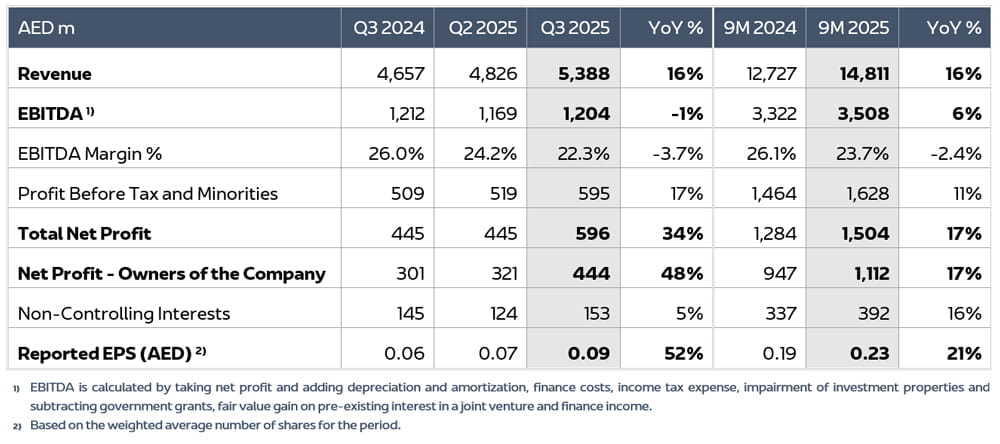

Double-digit operating profit growth in the infrastructure clusters Ports and EC&FZ, lower finance costs, and positive impact from income tax resulted in total net profit growing 34% YoY in Q3 2025

- AD Ports Group’s Revenue soared 16% Year-on-Year (YoY) to AED 5.39 billion in Q3 2025, driven by the Maritime & Shipping, Ports, and Economic Cities & Free Zones clusters.

- EBITDA remained stable at AED 1.20 billion in Q3 2025, implying an EBITDA Margin of 22.3%. Quarterly operating profitability was impacted by the restructuring of the former Digital cluster.

- Profit Before Tax stood at AED 595 million, up 17% YoY, supported by a 18% decline in finance costs coupled with a reversal of a previous impairment charge.

- Total Net Profit grew by a robust 34% YoY to AED 596 million on the back of a tax reversal related to the UAE corporate tax filing for 2024.

- EPS for the quarter stood at AED 0.09, up 52% YoY.

- Net Debt/EBITDA improved YoY, from 4.6x in Q3 2024 to 4.4x in Q3 2025, but was up from 4.1x in Q2 2025 due to the higher quarterly CapEx, with deferred associated revenue uplift.

- Net CapEx in Q3 2025 reached AED 1.69 billion, with the majority of cash outlays going into the Maritime & Shipping cluster for the acquisition of Ro-Ro, multipurpose, tanker, container, and marine services vessels. The additional vessels were sourced to fulfil existing contracts and agreements and will contribute to the performance of the cluster going forward. As a result, CapEx intensity stood at 31% of Group Revenue in Q3 2025.

- Operating Cash Flow, which reached AED 735 million in Q3 2025, was impacted by an increase in working capital and the first tax payment in the UAE (for FY 2024). Together with the higher CapEx, it led to negative Free Cash Flow to the Firm (FCFF).

Q3 & 9M 2025 Financial KPIs

Key Developments in Q3 2025

- Signed a dredging agreement at KGTL and KGTML (Karachi- Pakistan) to expand the capacity of container and general cargo operations, respectively. Container handling capacity at KGTL will be increased from 750,000 TEUs to 1 million TEUs whilst general and bulk cargo capacity at KGTML will double from 60,000 to 120,000 tonnes upon completion of dredging works, which are expected for Q1 2026.

- Commencement of upgrade works at Noatum Ports Luanda Terminal in Angola. Upon completion in Q1 2027, container capacity will increase from 25,000 TEUs to 350,000 TEUs, with Ro-Ro capacity exceeding 40,000 vehicles.

EC&FZ Cluster Developments

- Q Mobility will develop and operate the 84,000 m2 truck-parking facility in ICAD I – KEZAD Musaffah, and will manage on-street parking across ICAD I, II and III – KEZAD Musaffah, as well as Rahayel Automotive City.

Maritime & Shipping Cluster Developments

- Awarded a contract to Baku Shipyard in Azerbaijan for the construction of two 780 TEUs container vessels that will serve trade routes across the Caspian Sea.

Post-Quarter Events

- AD Ports Group sold a land plot to Mira Developments for AED 2.47 billion to develop one of the largest mixed-use communities in KEZAD Al Mamoura district of Abu Dhabi.

- China Southern Glass (CSG), a global leader in energy-saving glass and advanced materials, will establish its first overseas intelligent manufacturing facility in KEZAD. The project, which is located on a 95,000 m2 plot, represents an investment of AED 300 million. The facility will serve as CSG’s regional headquarters.

- Khalifa Port advanced to 39th position in the prestigious Lloyd’s List Top 100 Ports ranking for 2025, up from the 95th position since its first entry into the global ranking in 2019.

- 50-year agreements with Nimex Terminals to develop UAE’s first private-sector Liquefied Natural Gas (LNG) and Liquified Petroleum Gas (LPG) terminal hubs at Khalifa Port in Abu Dhabi, in a deal valued at over AED 30 billion.

- Sold two built-to-suit warehouses to Aldar for a total consideration of AED 570 million.